Etpa's Power Wallet and Collateral-Free Trading by Stefano Zambotti

Etpa’s Power Wallet and Collateral-Free Trading

Introduction

In the dynamic space of power trading, Etpa’s Power Wallet represents a revolutionary solution for enhancing a trader’s liquidity, and reducing costs, while minimizing counterparty risks and facilitating swift and transparent settlements between market participants.

Margining, a common practice in traditional energy markets, requires participants to post collaterals to handle default risks. However, with Etpa’s Power Wallet, participants no longer need to post collaterals, enhancing liquidity and financial flexibility. As a result, trading with Etpa requires up to three times less cash as compared to our competitors. When factoring in weekends and/or bank holidays, this amount increases even further.

Etpa's Power Wallet stands at the forefront of innovation in power markets, offering a collateral-free trading experience that simplifies transactions while ensuring efficiency, transparency, and safety.

This white paper delves into the architecture and operational framework of Etpa's Power Wallet, highlighting its key features, benefits, and its role in revolutionizing financial settlement in the power trading landscape.

Etpa’s Power Wallet - Easy & Efficient Financial Settlement

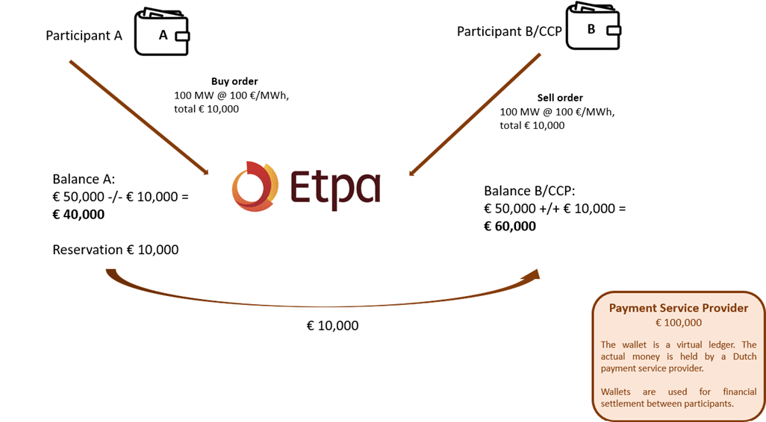

At Etpa, we offer a digital wallet system to our market participants. Each participant is assigned a unique power wallet within the Etpa system. This wallet is a virtual ledger, with the corresponding funds being securely held by a Dutch payment service provider (entity subject to PSD2) which acts as an escrow party and is subject to supervision by De Nederlandsche Bank (the Dutch Central Bank).

Trades are financially settled directly through the participants' wallets, each of which can only maintain a positive balance. When a buy order is placed with a positive price (or a sell order with a negative price), a reservation is initiated for the total value of the order. Upon execution of the order, funds are promptly transferred directly to the counterparty's wallet. In the event of order cancellation, the reserved funds are released back into the respective wallet.

Two are the possible indirect counterparties for Etpa’s market participants in a trade:

Collateral-Free Trading on the Single European Continuous Intraday Market

In spot power markets, margining has been playing a crucial role in managing counterparty risk. Margining refers to the process of requiring market participants to deposit collateral to cover potential defaults resulting from adverse price movements. Collateral, in this context, is a form of security that participants provide to ensure their ability to meet financial obligations.

With our Power Wallet, participants are restricted to placing orders that align with their available wallet balance. Therefore, no collaterals need to be posted. Deposits and withdrawals are swift, with wallet balances typically updated within a few minutes. It essentially entails a hassle-free and collateral-free process.

Collateral-associated costs

Collateral-associated costs include various factors that impact market participants. These include opportunity costs, interest costs, and transaction costs.

An overview:

The primary financial advantage of not having to post collaterals is the ability to retain and deploy capital more flexibly. By avoiding collateral requirements, businesses and investors can use their funds for alternative investments, operational needs, or strategic initiatives, potentially maximizing returns and maintaining liquidity without tying up resources in collateral.

Margining when trading with other Power Exchanges

In the context of financial clearing and risk management for power market transactions on power exchanges, the process involves assuming and effectively handling settlement and default risks. To manage credit exposures, systematic calculation and collection of margins from participants occurs regularly. A variety of methodologies, processes, and parameters are employed to determine margin requirements.

The process ensures the fulfillment of financial settlements between buyers and sellers, acting as a central counterparty for each trade. Due to the inherent inability to store electricity, a delivery-versus-payment settlement is not feasible. Consequently, open positions of participants are required to be always fully collateralized to minimize counterparty credit risk.

To proactively manage risk and minimize the frequency of margin calls, margins are collected in advance based on historical fluctuations of net payment positions and the credit rating of each participant. The calculation also considers the clearing calendar, considering that margin calls are not applicable on weekends and bank holidays.

The margin requirement for spot market products is typically calculated using three key variables:

To align with real risk exposure, margin requirements are usually calculated once every business day. However, the clearing of open positions occurs exclusively during business days, resulting in a time horizon for margin calculation that can extend from 1 to 6 days. This accounts for the impact of weekends and bank holidays on exposure.

Compared to Etpa's immediate financial clearing and settlement, this can result in a cash requirement that is up to three times higher. Additionally, when factoring in weekends and/or bank holidays, this amount increases even further.

Conclusion

In summary, Etpa's Power Wallet revolutionizes power trading by eliminating collateral requirements, ensuring swift and transparent fund transfers, and reducing costs. With an onboarding time of less than two weeks and enhanced safety, Etpa offers a hassle-free and efficient trading experience. Trading with Etpa requires up to three times less cash compared to competitors, providing participants with greater financial flexibility and optimization. Etpa's Power Wallet sets a new standard for efficiency and agility in energy trading, simplifying processes and ensuring security.